The Free Ad-Supported Streaming TV (FAST) market is expected to continue its explosive growth, and estimates put the FAST market reaching 1.1 billion users by 2027. This is a clear indicator that the way media, TV specifically, is consumed is constantly evolving. This rapid shift to new forms of TV consumption has reshaped the advertising landscape, and marketers need to stay ahead of the curve.

While the growth of this media segment is astounding, so too is the fragmentation of stakeholders vying for rights to sell the ad inventory. Amidst this complexity, media buyers often opt for convenience over comprehension, neglecting to delve into the intricate dynamics of the marketplace. Unlike other forms of digital advertising, FAST transcends simplicity by weaving together elements of digital, programmatic, and traditional broadcast television models. This amalgamation seems a formidable challenge for buyers seeking to accelerate the reallocation of budgets previously earmarked for broadcast TV.

In the spirit of helping media buyers and their gatekeepers be more educated on the streaming TV, and more specifically FAST, supply chain, it’s crucial to illuminate the supply chain dynamics and who has the most direct path to the content. In doing so,all players–the streaming platforms, programmatic marketplaces, ad tech vendors and channel owners–stand to benefit, allowing more reinvestment into the space to create the best end product for the consumer.

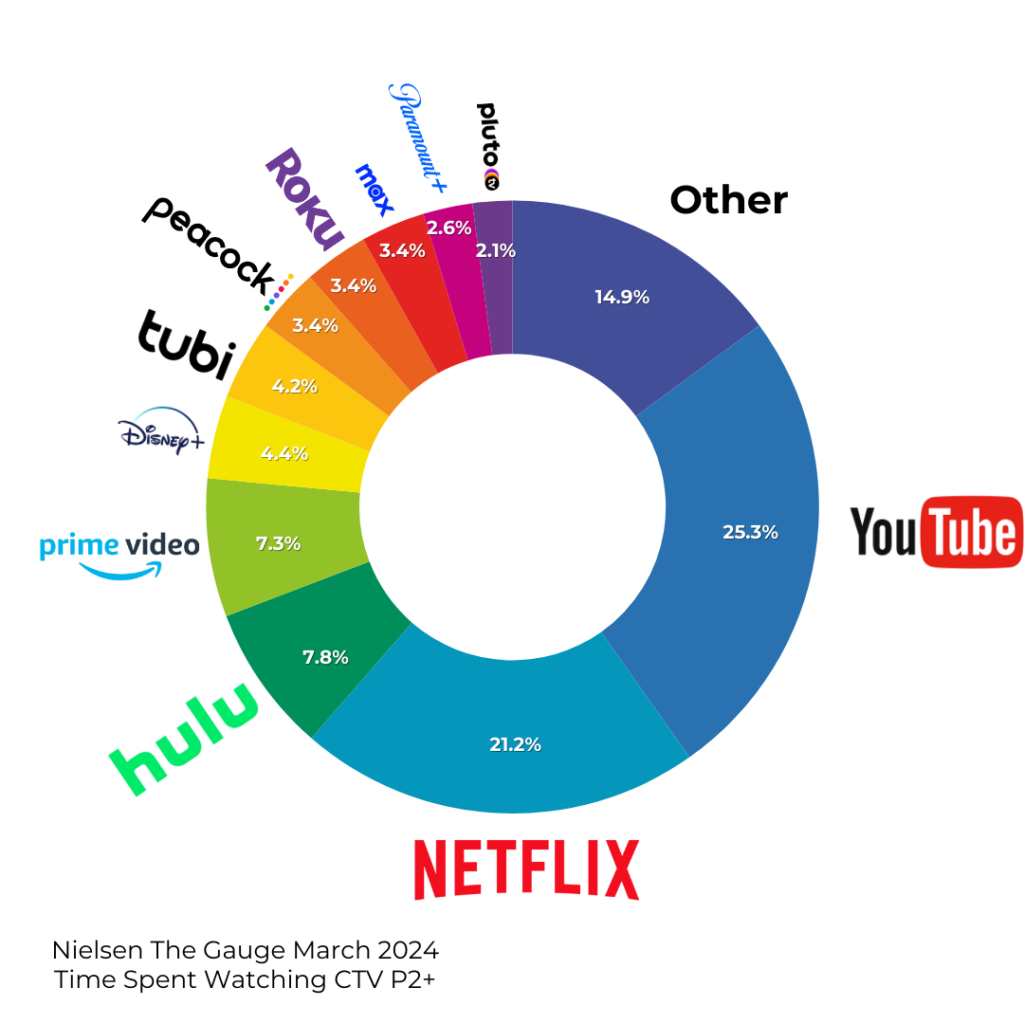

FAST is not like social or search, where 75% or 100% of your budget would have to go to just two companies (Meta and Google) in order to maximize spending. When a buyer wants to have the opportunity to access the bulk of the available inventory in streaming TV, it’s different and more like traditional TV advertising where things are just far more fragmented. Instead of just a couple of companies controlling the bulk of the user’s attention, FAST has several major players, each with a large share of attention. Eight large FAST services make up the lion’s share of free streaming users where advertisers can consider placing their ad dollars – Pluto, Roku, Amazon, Vizio, LG, Samsung, Tubi, and Xumo. THEN, you have all the FAST channel operators that control and sell their share of inventory on the free streaming services. Both provide the same direct supply path.

The number of streaming services with ad inventory available to sell to advertisers is extensive, creating fragmentation that confuses media buyers.

Nuance and fragmentation really do start to define this space, so let’s dig deeper into the area likely adding misunderstanding among buyers : the FAST channels. By my count, there are 125 unique app-ads.txt entries for inventory partner domains across six of those eight largest free streaming services. When you de-dupe the list for operators with multiple entries, remove the streaming services themselves, and ignore the service providers, you’re still left with more than 70 unique channel operators with the right to sell inventory across the top handful of free ad-supported streaming services.

That’s now 70+ additional sources of direct inventory for advertisers to tap into. It’s likely more than buyers want to manage, especially since they are notorious for focusing on scale above all else–what a real cynic might call laziness– especially when it is packaged nicely in a one-stop shop. Fortunately, the programmatic ecosystem more easily allows buyers to work across dozens of supply sources for FAST inventory by working closely with the SSPs to identify which sellers control the content, establishing relationships directly with channel operators, and setting up private deals. The extra little bit of work can be worth it, as it creates a more efficient working media buy.

You may be asking how channel operators get access to inventory from CTV apps they don’t own to claim as owned and operated. In social media, it would be like Instagram or YouTube, allowing the biggest creators to sell some of the inventory created from their videos and posts directly. While it is much less common in social of course, where creators rely on the platforms to sell all the inventory for a revenue share, in FAST, it’s closer to the norm. Channel operators regularly get the rights to sell inventory on the platform for delivering their channel and content as part of their carriage agreements. If you know how broadcast works, it’s comparable to the cable network (ESPN) sharing the ad inventory with the cable provider (Comcast).

In FAST, since carriage fees don’t exist like they do in broadcast, and there aren’t paid subscribers, many channel operators opt for what’s called an inventory share, where they get a share of the inventory to sell as their own. There is an official, IAB-endorsed method for verifying these relationships within app-ads.txt files called Inventory Partner Domain. It was designed specifically for CTV inventory sharing where, as the IAB Tech Lab ads.txt document puts it, in streaming, there is a higher occurrence of complex monetization relationships that make the old method of ads.txt insufficient.

The breadth of services and fragmentation of inventory rights holders may seem overwhelming, but the programmatic process can make things fairly straightforward as long as buyers embrace it. With that in mind, here are thoughts and advice for media buyers:

- Work with channel operators. Building partnerships beyond just a handful of streaming platforms seems wise no matter the situation and partnerships directly with the channel operators can bring real advantages like price efficiencies, transparency added targeting and customization.

- Keep the gatekeepers in check. It’s great that DSPs and buying platforms work to keep advertisers in safe inventory, but they often rely only on a handful of the largest service providers, neglecting emerging opportunities and taking a view primarily through the digital web lens rather than TV.

- Put existing tech tools to use. Verifying and managing 70+ new inventory partnerships may seem daunting, but utilizing existing programmatic buying tools like Deal IDs and scraping ads.txt to verify inventory partner domains will keep things efficient and not overwhelm buyers.

- Embrace the fragmentation. Have a good understanding of the space and accept that there are multiple sources to work with to access the bulk of the available inventory across streaming. This embrace can lead to buyers accessing more inventory within high-quality, high-value TV programming that’s fully verifiable from an IAB-standardized specification.

By understanding how the supply chain works and leveraging these unique targeting capabilities, marketers can reach new customers and achieve their goals in this exciting new media landscape.